What is Interest?

Interest is the price you pay to borrow money or the cost you charge to lend money. Interest remain generally expressed as an annual percentage of the loan amount. This percentage is called the interest rate on a loan.

The bank pays you to hold your money and use it to invest in other transactions. For example, a bank will pay you interest if you put your money into a high-yield savings account. Conversely, if you borrow money to pay off a large expense, the lender will charge you interest on the amount borrowed.

It is how interest rates work when borrowing money

You must pay back that principal (principal) to your lender each time you borrow money. In addition, you must pay your lender the interest set on the loan. These loans come in many forms. You can find them in credit cards, car loans, mortgages, personal loans, and more. It is essential to understand how interest terms and payment requirements work.

Suppose you borrow $10,000 from your bank in a simple loan with an interest rate of 4 per cent per annum (i.e. per year), and the loan has five years to be repaid. Interest on a typical bank loan is added to the monthly payments and remains typically compounded monthly. In this example, you would pay approximately $1,050 in interest over the life of the loan.

You can use Bankrate’s loan calculator to estimate how much interest you would pay.

How interest rates work in lending

Banks typically use several factors to determine your interest rate, including your credit rating and debt-to-income ratio. It also depends on the type of loan, such as B. a credit card or a home loan. In addition, business lenders also typically charge a fee for establishing a loan with a customer.

Suppose you apply for a loan of €5,000 from your bank. To determine the interest rate you will be charged, your bank must consider what interest you pay to receive the funds they lend you (e.g. 4 per cent). The bank also has loan administration and overhead costs, which they attribute to your interest rate (e.g. 2 per cent). And, of course the bank wants to factor in the risk of default and make some profit (e.g. another 2 percent). To account for these costs, your loan may bear an interest rate of around 8 percent.

The difference between interest and compound interest

There are two basic methods of calculating interest: simple interest and compound interest.

Simple Interest: With simple interest, interest payments are added to the monthly payments, but no interest is accrued. For example, a five-year loan of $1,000 at a simple interest rate of 5 percent per annum would require $1,250 over the life of the loan ($1,000 principal and $250 interest). You would calculate the interest by multiplying the principal, the APR, and the term of the loan: $1,000 x 0.05 x 5.

Compound Interest: Calculated by continuously accumulating interest on the principal plus interest calculated for the previous payment period. Compound interest is designed to generate higher returns, sometimes much higher than simple interest, by compounding the interest earned on the above terms. If you got the same loan as above but charged compound interest. You would pay just over $1,332 over the life of the loan ($1,000 principal and $132 interest).

For large, high-yield loans extended over the long term, the increase in the total amount paid can be significant with compound interest. For this reason, it’s always important to ask your lender or bank if a loan or savings account carries simple or compound interest.

Why to Write for Digital Life Hackers – Interest Write For Us

Search Terms Related to Interest Write For Us

[what is interest rate]

[what is interest in finance]

[what is interest on a credit card]

[what is interest in life]

[what is interest on a loan]

[what is interest in economics]

[what is interest example]

[what is interest in business]

Search Terms Related to Interest Write For Us

[Interest Write For Us” guest post]

[Interest Write For Us” submit news.”]

[Interest Write For Us“guest blogger.”]

[Interest Write For Us“guest posts wanted]

[Interest Write For Us“submit the post.”]

[Interest Write For Us“become a guest blogger]

[Interest Write For Us“guest poster wanted”]

[Interest Write For Us“become a guest writer.”]

[Interest Write For Us“become a contributor.”]

[Interest Write For Us” submit a guest post.”]

[Interest Write For Us“submit an article”]

[Interest Write For Us submit article”]

[Interest Write For Us“guest author.”]

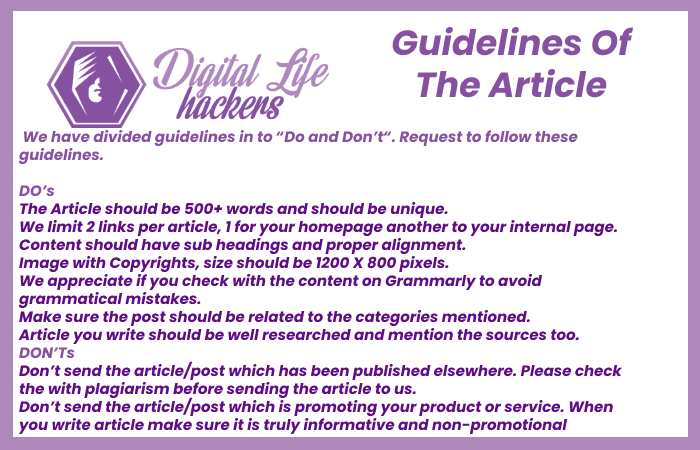

Guidelines of the Article – Interest Write For Us

You can send your article to contact@digitallifehackers.com

How to Submit Your Articles?

To Write for Us, email us at contact@digitallifehackers.com