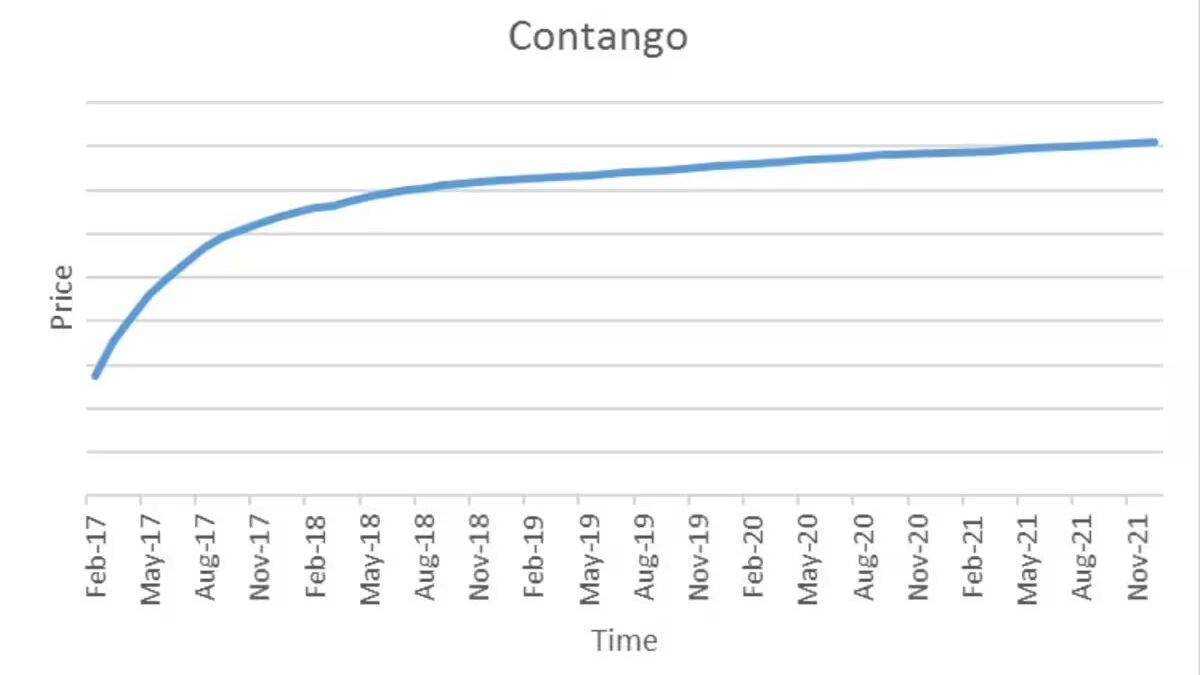

Contango Futures trading is the analysis of future commodity prices. It is essential to understand some technical terms that relate futures prices to current spot prices to trade futures effectively. One of those terms is Contango. Contango is a term that is associated with the commodity future market.

Table of Contents

Questions And Answers: Are Gold Usually In Contango?

The answer is a definite yes! Most raw materials are generally in Contango. The premium paid above the current cash price is often associated with maintenance costs.

These are the costs, such as warehousing or storage, insurance, and interest forgiveness on the money tied to the

As the expiration date approaches, it is always detected that the gold price forward in Contango converges downwards toward the future spot price of the commodity.

The opposite is observed in backwardation, where at expiration, the forward price of gold will converge upwards towards the expected future spot price of gold.

The Concept Of Contango Has Clear Itself Numerous Times In The Markets Throughout History.

The above price fluctuations explain why market participants are more than willing to engage in market contango. The Contango provides a unique opportunity to protect yourself from unpredictable changes in commodity prices in the market that can severely damage your bottom line.

For example, it is expected (almost standard) for airlines to routinely buy oil futures to have stability in their business model and returns.

If the airlines bought oil at their market prices, when necessary. It would be devastating, and they could collapse at some point. Buying futures contracts help companies plan for stable prices over a guaranteed period.

In the long term, the actions of market participants rebalancing their portfolios can affect asset prices. When purchased futures contracts, the increased demand causes short-term prices to rise. But now, with the market awash with future supply, prices are correspondingly lower, effectively removing Contango from the market.

Naturally, Lead To Backwardation

Which many analysts and financial experts believe is the norm in commodities.

Backwardation is when futures prices are lower than current spot prices. It is a common scenario for perishables and leads to higher demand in the future, less supply, and consequently higher prices.

But for non-perishable goods with high maintenance costs, the consensus is that they offer an excellent opportunity to buy (call options) in the futures market. It makes Contango more common

Understanding Contango in Practice

These are storage fees, financing costs, or insurance charges. Because of the continuous variations in the opinions of the market participants such as investors, traders, and speculators. Forward price curves in the market can easily alternate between Contango and backwardation.

Convenience yield is the implied benefit or yield of physically holding commodities rather than futures contracts. It is the premium derived from maintenance costs.

The theory states that sellers would be willing to sell an asset (commodity, such as gold or oil) at a discount from the expected price to offset the impact of volatility in financial markets.

For example, a major oil-producing country may be willing to set futures prices lower than expected prices to provide economic stability for its population.

Begs The Question: Is Contango Bullish Or Bearish?

In Contango, futures prices for a commodity expect to be higher than current spot prices. Still, the forward price curve will converge downward to meet the expected spot price at expiration.

Despite this, it does not matter since Contango is a bullish situation simply because market participants expect higher market prices in the future. Investors are optimistic that the underlying commodity prices will appreciate in the future.

The Convergence of Futures Prices and Expected Spot Prices

The reason traders or investors look at Contango and backwardation is the relationship it details between futures prices and spot prices. If this doesn’t happen, an arbitrage opportunity will occur in the underlying market to offer “FREE MONEY” to traders.

Whether The Situation In A Market Is Contango Or Retracement

the fact that the forward price curve converges to meet the spot price at expiry offers immense trading opportunities for speculators.

During the Contango, the idea will be to go long on futures contracts. As the expectation is that prices will continue to rise. But as expiration approaches, the thought will be on futures contracts as futures prices converge to catch up with spot prices.

This Will Be True In The Case Of A Backwardation Situation.

Speculators can go short when expiration is still far away as future prices decline. But as the end approaches. The idea will be to prolong the convergence of forwarding expenses upwards to catch up with spot prices.

The bottom line is that both Contango and backwardation reflect opposite sides of the same coin. Both also offer exciting opportunities for speculation in the short and medium-term.

Frequently Asked Questions about Contango

Contango is an indicator of bullish sentiment in the market. The underlying asset price is likely to rise a lot in the future. Market participants are willing to pay more for the product in question as time goes on. A bull market is one in which prices reach higher highs and higher lows, and this is what a contango situation in the market implies for futures prices. On the other hand. Backwardation is a bearish indicator because market participants believe that prices will go down as time goes on.

When Is Contango Bad

It is essential to remember that stock market CFDs have a delivery date; they cannot keep indefinitely. Consumers who want to receive the commodity will have no problem with the delivery date. Still, there is a concern for investors speculating on the underlying thing with no Intention Of Owning It. Issuers of Commodity ETFs use what is know as “rolling.” which involves selling forward-date futures and buying back-dated lots on the same commodity. Allows investors to maintain exposure to a particular entity. However. It is essential to note that rolling over also carries additional trading costs. Both in the value of the futures contract and in moving charges.

When Is Contango Good

Contango also has its advantages. Some arbitrage opportunities may occur, allowing traders to buy assets at spot prices and sell at future prices, pocketing the difference. In cases where inflation is rising, there is an opportunity to purchase futures contracts to expect prices to continue to rise higher and higher as time goes on. However, this is an inherently risky strategy because it only works when prices continue to increase.

Ready to use your knowledge of Contango and backwardation to trade the markets? Sign up for Overtrade and put your knowledge to the test.